Imagine that you are the government and you have identified that there is an urgent need to reduce the national Carbon emissions. So, you set about designing incentives to motivate investment.

Does it then make sense after setting up your incentive scheme to introduce taxation on these investments that stops take up? Obviously not, and yet that is where we find ourselves.

Worse still, we now have renewable energy schemes that would be investible with no subsidy except that taxation prevents take up.

This is a bad tax – a tax that prevents economic activity and raises no tax revenue.

The prime example of this is the application of business rates to renewable energy generation, in particular, on roof mounted commercial PV.

With the value of exported energy running low – especially for small installations – the business case of commercial PV generation is heavily dependent on maximising on-site use.

However, in setting up business rates for onsite generation, the rateable values have been set so that if the majority of the generation is for on-site use, there is a higher rateable value. I have never understood the logic of this as an installation for export is much more obviously a separate business activity whereas generation for on-site use is more akin to improving your insulation or fitting more efficient lighting, neither of which would be considered for rates.

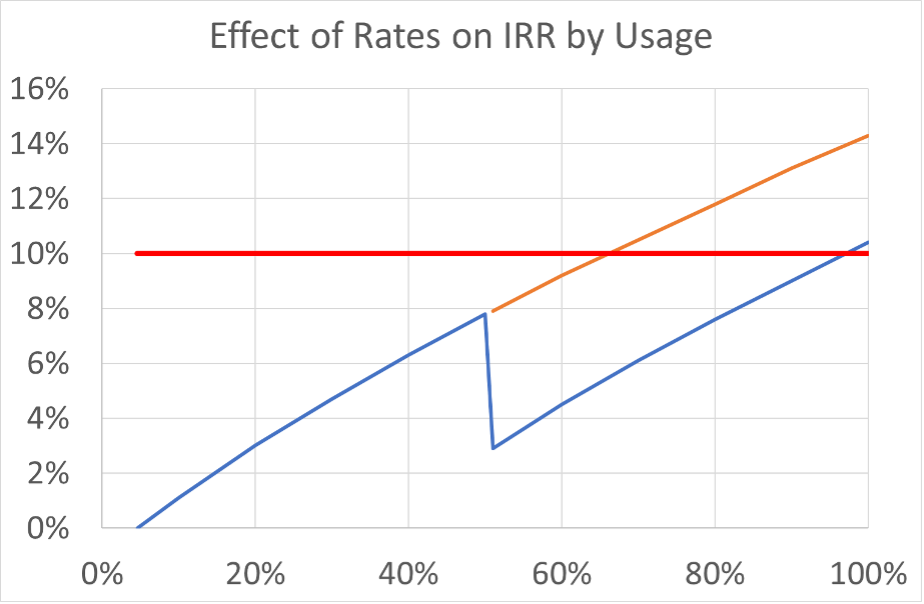

If we look at a typical non-ideal project in a less sunny part of the UK with a notional 10% minimum investment threshold, we can see the effect. The impact of business rates on the rate of return is shown below. If the rateable value was not increased when on-site use is above 50%, the IRR threshold would be reached at 75% on site use. With the increased rateable value, it is never reached.

This definitely meets the parameters for a “bad tax” because its existence prevents economic activity and no tax is received. If the tax hike above 50% on site use were removed, or better still, the take out or rates altogether, lots more businesses would install PV on their roofs subsidy free, generating tax revenues from the VAT, employment related taxes and increased profitability of the business.

This is just one particularly glaring example. Every added cost to renewable projects reduces the number of viable projects and hits both Carbon reduction and tax revenues. CCL is another example of this where the removal of LECs has effectively removed £5.50/MWh to renewable generation value.

A recent analysis by Energy System Catapult looked across the main types of energy use to compare the tax take and it is extraordinary reading.

https://es.catapult.org.uk/reports/innovating-to-net-zero

This has some clear anomalies – for example the tax take on road and rail includes the revenue that funds provision of the infrastructure – but it does clearly show that the Government are not taking a holistic or imaginative approach to the use of taxation to drive behaviour towards net zero Carbon.

The FT did a reanalysis of the data to centre the data on zero as no subsidy and this shows that the effective tax on business electricity is £54 per whereas domestic gas gets an effective subsidy of £13 per t CO2. Air transport has a whacking £24 of effective subsidy which perhaps helps explain why rail cannot compete on price.

All of this is just to make the point (some of which overlaps my earlier article on cheap gas) that we need Government to grasp the nettle of the tax system and clear out the bad taxes that are preventing Carbon reduction.

And as a parting shot, if you think that Government is incapable of realising that tax reduction can raise more tax receipts, can I draw your attention to the EIS tax relief system?

To quote from a recent FT article on EIS: “The benefits of the EIS have remained generous – in fact, they’ve become more generous. Until April 2011, the up-front tax relief was 20 per cent. Today it is 30 per cent.

Those aren’t the only benefits: your investments are free of capital gains tax, you get loss relief, and your pot becomes inheritance tax free after two years. By investing via the EIS, you also have the option of deferring capital gains on assets outside of the wrap.

Compare that with what has happened towards pensions in recent years – just a decade ago you could put £255,000 into your pension each year. Now it is £40,000, and only £10,000 for the highest earners.

Since 1994, 27,905 companies have received investment of over £18bn via the EIS. It is estimated that, in the past decade alone, the EIS has cost the Treasury over £3bn in tax relief.

So why does the government continue to offer EIS investors such generous tax breaks?

The reason for this is simple: it benefits the economy by supporting innovation, which in turn increases productivity, creates jobs, and boosts growth. Our research suggests that in the long term it actually makes the Treasury money.”

© John Moore 2020

Note: this article is the third of a series on barriers to net-zero Carbon and is intended as a debate initiator. Data sources are: Valuation Office Agency, Energy System Catapult, FT .